franklin county ohio sales tax on cars

The total sales tax rate in any given location can be broken down into state county city and special district rates. There are also county taxes that can be as high as 2.

Ohio S Highest Local Property Tax Rates Some Homeowners Pay Four Times The Rate Of Others Cleveland Com

The Franklin County sales tax rate is.

. The minimum combined 2022 sales tax rate for Franklin Ohio is. This rate is made up of a 675 state sales tax rate and a. Franklin County Ohio Sales Tax On Cars.

This is the total of state and county sales tax rates. Ohio has a 575 sales tax and Franklin County collects an additional. How Much Is the Car Sales Tax in Ohio.

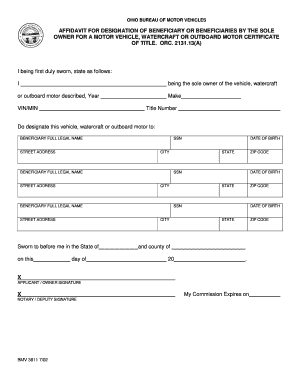

What is the sales tax on cars in Franklin County Ohio. Franklin Countys is 75. The inspection forms are valid for 30 days from date of inspection.

The Ohio sales tax rate is currently. The current total local sales tax rate in Franklin County OH is 7500. Bring in your out of state title inspection.

The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance to which you may be entitled. You may obtain county sales tax rates through the Ohio Department of Taxation. Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange. Some dealerships may also charge a 199 dollar documentary. As of January 1 2020 the sales tax rate for Franklin County Ohio is 725.

The latest sales tax rate for franklin oh. The December 2020 total local sales tax rate was also 7500. Download all Ohio sales tax rates by zip code The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local.

According to the Sales Tax Handbook you pay a minimum of 575 percent sales tax rate if you buy a car in the state of Ohio. Additional evidence may be required based on unique titling situations. You need to pay taxes to the county after you.

Or visit our Ohio sales tax calculator to lookup local rates by zip code. 2022 Ohio Sales Tax By County Ohio has 1424. This is the total of state county and city sales tax rates.

17TH FLOOR COLUMBUS. Its important to note this does not include any local or county sales tax which can go up to. The County sales tax rate is.

Overview of the Sale. If you need access to a database of all Ohio local sales tax rates visit. The properties in community reinvestment areas in franklin county had an.

Taxes are due on a vehicle even when the vehicle is not in use. Have your car inspected at a new or used car dealership or any Deputy Registrar. Franklin county ohio sales tax on cars.

The Ohio state sales tax rate is currently. The current sales tax on car sales in Ohio is 575. The 2018 United States Supreme Court decision in.

Sales Tax On Cars In Franklin County Ohio.

Ohio Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Sell A Car In Ohio Sweeney Chevrolet Buick Gmc

Cheapest States To Buy A Car Forbes Advisor

Ohio Car Registration Everything You Need To Know

Franklin Township Police Department Columbus Oh

Used Cars For Sale In Columbus Oh Under 10 000 Cars Com

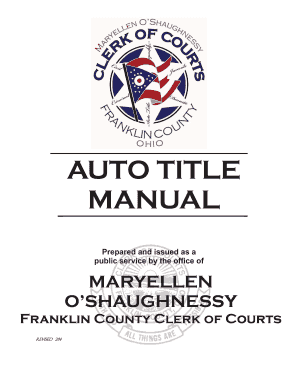

Auto Title Faqs Franklin County Clerk Of Courts

Ohio Title Inquiry Fill Online Printable Fillable Blank Pdffiller

Franklin County Is Modernizing Not Only Its Jail But How It Operates Wsyx

State Lawmaker Introduces Property Tax Relief Bill To Cap Annual Increases In Ohio Wtte

Ohio S New Car Sales Tax Calculator Quick Guide

Used Cars For Sale In Columbus Oh Cars Com

Motor Vehicle Taxability Exemptions And Taxability Department Of Taxation

Maine Sales Tax Calculator And Local Rates 2021 Wise

Ohio Woman Killed In Car Vs Tree Crash Wowk 13 News

2018 Ohio Demolition Derbies News And Events Volunteers Of America

Used Cars For Sale In Madison Wi Cars Com

Franklin County Title Office Form Fill Out And Sign Printable Pdf Template Signnow